Recent Posts

why i want an officer level govt jaab

I thought this would make me happy but

Beginner guider (Water thread)

are you riding the silver wave too?

Freelancing income

Investment plan

INDIA-EU FTA

How do i make money from AI

NEETs assemble

India agreed to buy Gold and rare metals to fix th...

Modi ji talking about digital currency

ultimate forex master

Do you agree??

नागरिक देवो भवः

Gst Reform discussion

Cian Agro Industries&Infrastructure Ltd

Thread to discuss the state of the economy

bros....

/FREE/bies thread

Matt levine newsletter

test

BEST isp?

FD or Gold

BBC Money

Another instance where media is enemy of the peopl...

yH4e0L

No.358

If anyone wants to know more about day trading,

thread #9762 on inch of 8moe

dEXetx

No.359

>>358(OP)

dhanyavaad mahoday

dEXetx

No.360

>>359

Grettings Bh*,

You know whats comfier? Being neet and having money. Imagine shitposting all day while eating gourmet and going on at chilly night

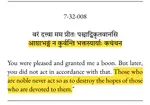

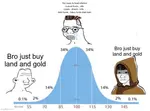

I’m going to share what I know about market; day trading. In a year with consistency youse should be able to call it an income. Remember, the trick to consistency is to keep it simple. At least until youre fully matured. In fact, hardwire this.

I’ll be taking you through multiple stages. It will start with basic pattern recognition then to analytics and to understanding how anything works. Minimum 95 IQ is required; no lies, you will halt at second stage and only trade under certain conditions but you’ll still have some income.

There are many ways to trade markets, most famous being technical analysis where you are guessing what the combined output of 2 or more technical indicators possibly means and putting your money on it. However, its not artistic. Gradually, you wouldnt need to look at any indicator, including volume because when the market is going to have momentum, it will have it regardless of what any indicator says. Because essentially indicators are giving you a signal after happening starts happening. The artsy way of trading is to understand what the market will do next before days.

Is this relevant for mlecchas? Yes, with adjustments. The nature of average person differs from culture to culture. Nature towards money, panic, making money, being aware of tech etc. So, the price action will adjust that behavior. For example, a panic sellout could look steeper and shorter in matured countries under same levels of input.

Meanwhile, I suggest you to read a book called, reminiscence of a stock operator. Its just a story, it doesnt really teach all that much about how to, but its a classic anyway. The guy indeed traded by understanding how the market behaves. Also, a video by ray dalio on how economic machine works.

I will return after 10 or 20 days. Youse are free to explore markets, read web and write a paper on what you understand. Remember, keep it simple just follow the Nifty 50 for its contracts.

If youre bored sitting at home, I suggest you try an Investment Banking sector. Its easy to get 500.000 package as a fresher or entry level job and actual job is as good as data entry. If you did good you could get in company that allows work from home and has free beers and unlimited snack. Although, you’ll need to be able to speak; at least in interview and carry yourself. Just read about derivatives - options, swaps, and fx mainly, options formulas, OTC trade life cycle, Fixed income instruments, Accrued bond interest calculation, Aml/ kyc, Corporate actions, ISDA and its template, how various department work in the sync. And on soft skill part, walk me through your resume, elevator pitch, what were you doing being a neet etc. And with growing India, this job market will likely to stay consistent. So, without much effort you will be making more than IT coolie.

PS.- I dont have any prooofs that this works for now as I deleted my account and dont plan on trading for a while. The earliest I can post proof of my accuracy is 6 months.

>inb4 fir 6 mahine baad ana

Qh9ei2

No.666