Recent Posts

why i want an officer level govt jaab

I thought this would make me happy but

Beginner guider (Water thread)

are you riding the silver wave too?

Freelancing income

Investment plan

INDIA-EU FTA

How do i make money from AI

NEETs assemble

India agreed to buy Gold and rare metals to fix th...

Modi ji talking about digital currency

ultimate forex master

Do you agree??

नागरिक देवो भवः

Gst Reform discussion

Cian Agro Industries&Infrastructure Ltd

Thread to discuss the state of the economy

bros....

/FREE/bies thread

Matt levine newsletter

test

BEST isp?

FD or Gold

BBC Money

Another instance where media is enemy of the peopl...

Gst Reform discussion

KO6NXJ

No.464

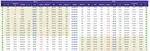

ITT we discuss changes in tax rates, kekda, majdoors on suicide watch.

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2163555

link for items being changed

KO6NXJ

No.465

likely coke, diet coke and other cold drinks will see increase in price, same for cigarettes.

KO6NXJ

No.466

ig, they have removed all tax from healthcare items? i am seeing nil for drugs.

5s1oKC

No.467

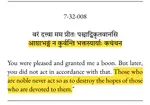

/b/ threads was to contain the jingoism. Here's summary snippet of the GST reduction.

KO6NXJ

No.468

5s1oKC

No.469

>>464(OP)

Interesting going through the list, one of the clear major change is in reduction of taxes on consumables - health related stuff most are now reduced from 12% or 18% to just 5% in many cases nothing.

Another thing to note is that cement, etc. tax has been reduced to 5% interesting stuff for construction segment.

Solar cells etc. have also been reduced.

Lots of science related stuff - chemicals are now either reduced to 5% or nothing.

Electronics - monitor/tv/ac etc. have seen clear reduction.

Good stuff for farmers too.

KO6NXJ

No.470

>>469

whatever is consumed by general public which is poorfags, lower middle class and middle class, is reduced.

5s1oKC

No.471

>>470

yep

mJ/VMu

No.506

cOuX/p

No.517

>saar pleaje consooom saar

Nothing ever happens.

r8hPfV

No.518

>>506

dudu pee lo

mJ/VMu

No.519

>>518

vo to m roz pita hun

cOuX/p

No.520

>>517

>no GST on notebooks and stationery

Now that's based... I can buy some nice planners and notebooks.