Recent Posts

Holy shit this was actually soul crushing and dark

Weekend suifuel

This owl meme is older than most of bhch

GRAH KALESHHHH

crypto

No worthwile discussion on bhach happens in hindi

I went to watch a movie alone

GF going to US, how to get sexxo now

Dyaush, your video just dropped

Kalej finished

DGH

Wanted to watch a movie but went for lunch instead...

ITcels please help

Indian imageboard

Diversity

90% of threads are related to foids

crypto

tTZHQ3

No.132401

Stay alert: Crypto is turning into a geopolitical weapon

I am not a fan of Bitcoin and other crypto-currencies... Unregulated crypto assets can facilitate unlawful behaviour." That was Donald Trump in 2019, when he still voiced concerns shared by central bankers, International Monetary Fund (IMF) economists and financial crime experts across the world. The consensus was clear: crypto, while technologically innovative, lacked both intrinsic value and sovereign backing, and undermined antimoney laundering regimes as well as monetary integrity.

Fast forward to 2025. Better educated perhaps by the America crypto lobby's cam-paign cheques and the sweat equity gifted to his family, Trump, now US president again, recently signed Executive Order 14178. A stroke of the pen dismantled many of the regulatory guardrails once deemed essential. Not long after, the Trump family entered the crypto business. One of their earliest strategic partners was Pakistan, a state associated with crossborder terrorism, shady finances and furtive fund diversion.

What should India make of a superpower whose political leaders launch private currencies? Or of a country where former convicts are rehabilitated as strategic advisors to sovereign crypto councils? Are we witnessing a global power in search of infinite minting rights without democratic oversight but with the full cover of plausible deniability?

Changpeng Zhao, former CEO of Binance, pleaded guilty to serious anti-money laundering failures, spent time in US custody and paid $4.3 billion for a settle ment. His crypto exchange facilitated transactions for sanctioned groups like Hamas flows that would never get past a regulated banking system. The Binance blowup should have ended his financial career. Instead, he now advises Pakistan's official crypto task force. Justin Sun, whose firm invested $30 million in Trump-linked World Liberty Financial, was under investigation by the US Securities and Exchange Commission for civil fraud. Today, he is a frontrow guest at US political fundraisers.

Are crypto dealings the new way to buy influence in the US? This seems like a gateway through which otherwise ineligible actors be it individuals, regimes or rogue states are quietly admitted into the global financial order, now that the need for institutional legitimacy appears to be receding behind the opacity that once resulted in exclusion. It's a return to Cold Warstyle shadow financing, but with the support of blockchains instead of banks. So much for the superpower that lectures the world on clean governance. When financial opacity is rebranded as innovation, geopolitics takes on a new form we should all be wary of.

The IMF and World Bank have been vocal in their concerns. The IMF has warned that widespread adoption of private cryptocurrencies threatens monetary sovereignty, enables illicit flows and undermines capital controls, especially in emerging markets. We saw disruptions in El Sal-vador, Nigeria, and Lebanon, where crypto exper iments coincided with capital volatility and institutional erosion.

Terror finance remains an enduring threat to global security. The Financial Action Task Force (FATF) has repeatedly highlighted how terrorist groups exploit crypto to bypass formal banking oversight. Yet, Pakistan has FATF clearance. Fora country like India on the frontline of crossborder terrorism-this is a real risk. Crypto has operationalized what could be described as 'eHawala': borderless transfers in real time that can stay hidden.

A sovereign nation should not let private entities mint currency, however trendy or popular it proves. To its credit, the Reserve Bank of India saw this coming. Its resistance to private cryptocurrency is neither timidity nortechnophobia-it is an assertion of monetary sovereignty. In today's world, capital flows can be weaponized. It is therefore a matter of national security to ensure such weapons are Yet, the pressure to

tTZHQ3

No.132402

In India, domestic actors have lobbied against India's high tax on crypto gains by

arguing that crypto capital must be stopped from fleeing offshore. In matters of financial security, arguing that crypto should remain unchecked because conventional checks aren't flawless is not just illogical, but dan-gerously juvenile. Even if the US exerts diplomatic pressure, India mustn't oblige.

Instead, India should put systems in place for crypto deterrence. Cutting-edge surveillance tools, forensic finance capabilities and offensive digital arsenals could be deployed against adversarial scenarios of crypto being used as a Trojan horse to destabilize our financial system. Just as strategic weapons are kept discreet, so must this.

The future of finance may well be digital. But that future must be guided by sovereign plans, not determined by offshore hype or patronage games. In the crypto age, our sovereignty must be defended with the same strategic intent that we apply to borders, seas, airspace and cyberspace.

Crypto is now a geopolitical instrument and potentially a vector of strategic harm. It needs to be viewed as a weaponizable tool, even as we secure our financial architecture from any threat it may pose. This is no longer a matter for committees to discuss. It is a political decision one that cannot be deferred without consequences.

QUICK READ

Crypto is a tech the US under innovation that Trump seems bent on legitimizing, but it can be used to fund illicit activities and also be weaponized to destabilize a country's financial system.

India must guard its sovereign exclusivity as a currency issuer and set up a defence apparatus with cutting-edge digital tools to secure the country from any crypto threat that may arise.

hiHtfB

No.132414

>>132401(OP)

interesting read. bump

tTZHQ3

No.132427

>>132424

there is a quick read to

ruxqw+

No.132428

Yaar gareeb

ngigpK

No.132431

>>132401(OP)

>>132402

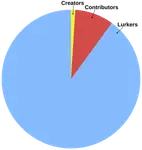

"Crypto is becoming a geopolitical weapon" as if the actual weapons, offshore accounts, and lobbying cash weren't already doing the job just fine.

Honestly, pretending to be surprised that governments and elites found a new way to move shady money is like being shocked that water is wet or that politicians suddenly care about tech right after someone donates a few million in tokens.

Crypto isn’t just digital gold, it’s digital déjà vu. The tools are new, but the game is ancient. Same corruption, now with more buzzwords and less traceability.

Maybe the only real upgrade here is that now, even your neighborhood scammer can dream of geopolitical influence, as long as he has a Wi-Fi connection and a memecoin.

zZDQEn

No.132433

>>132427

Read that.

>India must guard its sovereign exclusivity as a currency issuer and set up a defence apparatus with cutting-edge digital tools to secure the country from any crypto threat that may arise.

Lmao, what will actually happen is that some pajeets shaking hands with government will launch a super retarded "cryptomudra" to scam the citizens and ban every other crypto. Not to mention they already eat 30% on crypto gains. Which would be highly volatile and not better than owning literal stocks